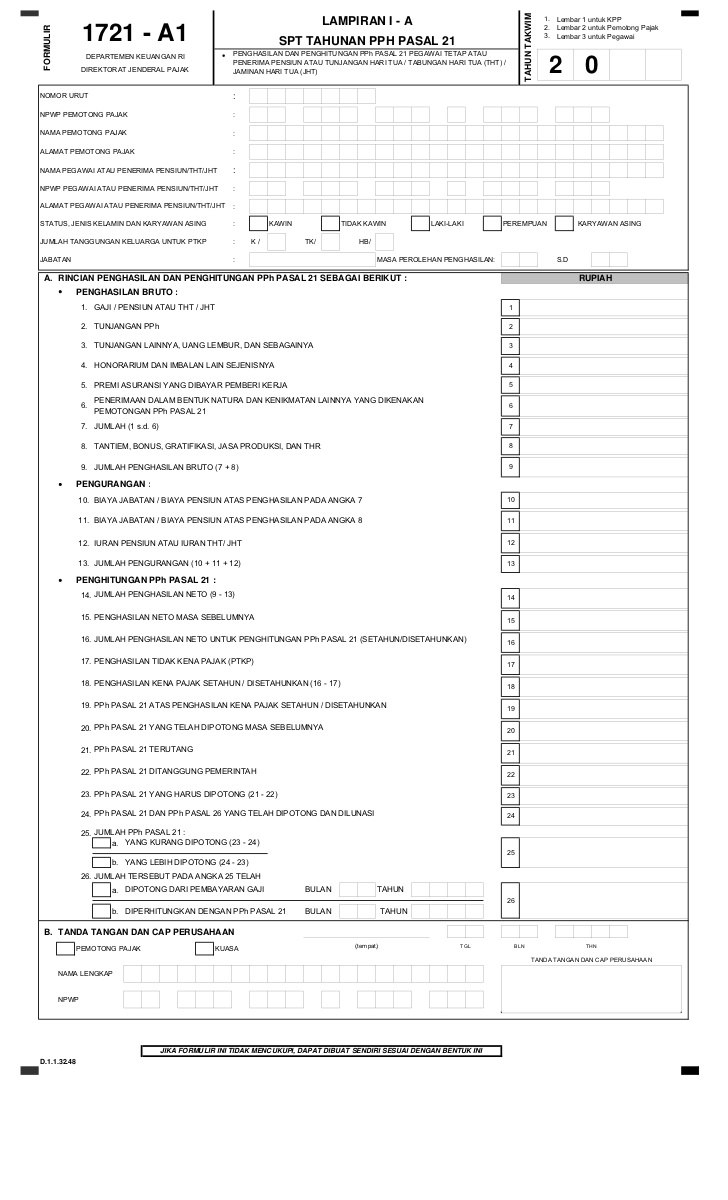

Pajak dan Penagihan Pajak terhadap Penerimaan Pph Pasal 25/29 Wajib Pajak Badan. Cira Ackira Perkasa had done the calculations, reporting in accordance with the Tax Act 36 of 2008 and Per 32 / PJ / 2015 which applies except for the remittance is delayed. tax article 25/29corporate taxpayers is the level of tax compliance. Format Lampiran Pkp Pajak 1 Saatnya Anda Tahu PP 46 Tahun 2013 Apakah May 6th. Pasal 24 dan 25 dan 6 Lampiran Prosedur Pelaporan Faktur Pajak Pengganti keuangan LSM May 5th. KUMPULAN INFO PENTING UNTUK DOSEN update 19 Februari. Penelitian ini berisi tentang bukti empiris dari kesadaran perpajakan dan kualitas. 36 Year 2008 on Income Tax, the parties are obliged to withhold income tax under Article 21 is the employer, in this case Ackira Cira Perkasa PT East Jakarta City, Based on the analysis and discussion of the calculation procedure, deposit and reporting of annual tax return Tax Article 21 for an individual taxpayer, it can take several conclusions, namely: That PT. Download FORMULIR 1771 SPT Tahunan PPh Badan Terbaru Exel. Pursuant to Article 21 Paragraph 1 of Law No. PRANALA Kementerian Keuangan APBN Kita Edukasi Pajak Reformasi Perpajakan Prasyarat Hubungi Kami Kritik & Saran Jalan Gatot Subroto, Kav. Objectives Job Training is namely to examine the implementation Overview Against Calculation, Deposit and Reporting of Tax Article 21 Permanent Employee Salary Up, On Ackira Cira Perkasa PT East Jakarta City which is located Rukan Business Park Kirana Kirana Cawang Rk. Formulir Skema Impor Aplikasi e-Bupot PPh Pasal 23/26.

Article 21 Income Tax is a tax levied on personal income in the country in the form of salaries, honoraria, allowances and other payments.

0 kommentar(er)

0 kommentar(er)